Are you looking for a better solution for your cash positions?

At BAC Community Bank, we are focused on helping you make the most of your money. The Demand Deposit Marketplace® (DDM®) program is one of the most flexible cash management solutions available in the market to assist with increasing FDIC insurance coverage through participating insured banks. The DDM® program provides you with access to scores of banks that, together, can offer millions of dollars in FDIC insurance coverage with daily liquidity. The DDM® program is an ideal option for individuals, businesses, and non-profit organizations seeking safety that is competitive with other options while decreasing overall portfolio risk.

Benefits

- FDIC insurance reduces the risks associated with money fund investing

- Diversification of deposits among multiple FDIC insured banks reduces overall exposure

- Access to millions in FDIC insurance through participating banks

- Deposits up to the program maximum (currently $60M per tax ID)

- Avoid the burden of dealing with numerous bank relationships and benefit from a high level of FDIC insurance through a single contact point

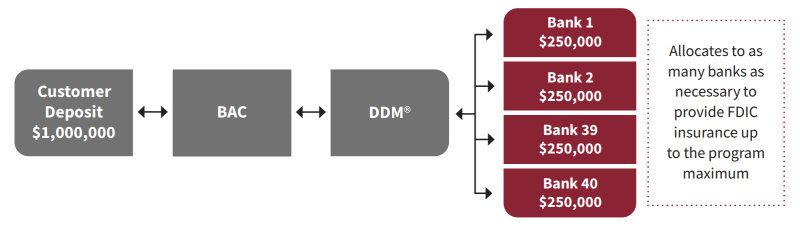

How DDM® Works

Customer target balances are sent daily into the DDM® program and allocated into several program banks to ensure high levels of FDIC Insurance

Have more questions?

We are here to help.

FAQs

What is the Demand Deposit Marketplace® (DDM®) Program?

The Demand Deposit Marketplace® (DDM®) program is a liquid FDIC insured alternative to money market mutual funds offered through participating banks. It enables customers of financial institutions participating in the DDM® program (“DDM® Participating Institutions”) to obtain millions of dollars of FDIC insurance with daily liquidity.

What is the FDIC insurance limit in the account?

Joint accounts receive up to $120 million in FDIC insurance, and all other account types receive up to $60 million per TIN. However, individuals in different categories of legal ownership may receive higher amounts.

How are high levels of FDIC insurance achieved?

BAC will sweep balances that exceed your target balance and transfer the funds to the DDM® Program on the following business day. The Program will allocate those funds in increments of no more than $250,000 to multiple DDM® Receiving Banks that abide by the FDIC pass-through insurance provisions established by the FDIC. By allocating deposits to multiple banks, customers receive high levels of FDIC insurance while maintaining daily liquidity and the convenience of maintaining one bank relationship.

When placed into the DDM® program the following business day, are customers’ deposits insured?

During the overnight sweep and intraday transfer process, funds may not be insured until the transfer is complete.

Funds will be insured on the following business day once transferred to the Participating Bank.

How is the DDM® program different from a money market mutual fund sweep?

Unlike DDM®, money market mutual funds are not FDIC insured. Operationally the DDM® program works similarly to a money market mutual fund sweep; however, deposits are placed into insured accounts held at several FDIC insured program banks instead of pooled money fund investments.

What are the advantages of an FDIC insured account versus a money market mutual fund?

- Provides the safety and explicit guarantee of FDIC insurance backed by the full faith and credit of the US Government that money funds do not offer;

- Eliminates market risks associated with money fund investing;

- Is outside the scope of the SEC’s money fund reforms.

What if the customer does not want their money deposited in a particular DDM® Receiving Bank?

Customers have the option to exclude any DDM® Receiving Bank they choose. However, by opting out of one or more DDM® Receiving Banks, it may affect the maximum amount of FDIC insurance they may receive.

What if the customer’s Participating Institution fails?

Assuming that the first $250,000 of the customer’s funds remains at the Participating Institution (and it is an FDIC-insured bank) with the remainder placed into the DDM program, then the following would occur:

(1) An FDIC claim would be filed on behalf of the customer for the $250,000 that remained at the Participating Institution. It typically takes two business days for the FDIC to settle such claims, but it could be longer.

(2) The funds placed into the DDM® program are not impacted. Rather, those funds are placed at other FDIC-insured banks and similarly protected by FDIC insurance and continue to be available to the customer either through (1) the Participating Institution in a wind-down mode, under the conservatorship of the FDIC or a transitioning Participating Institution; or (2) Stable.

Can placing funds in the DDM® Program decrease customers’ overall portfolio risk?

Yes. FDIC insured placements reduce the market risks associated with money market mutual fund investing and other direct cash instruments.

Have more questions?

We are here to help.

The services we provide with respect to sweep and other programs are primarily designed to provide administrative convenience for our clients to offer expanded FDIC insurance on customer funds. The services we provide are not designed to provide customers with investment enhancements, or higher rates of returns on their funds.

The Demand Deposit Marketplace® (“DDM”) program is offered to you by BAC Community Bank (“us” or “we”), subject to the terms and conditions set forth in the DDM program Terms & Conditions provided to you. Please connect with us regarding your participation in the DDM program, including the DDM program Terms & Conditions, your customer statements, and any questions you may have. Please contact us for a list of banks in which your funds could be deposited through the DDM program. The DDM program is administered by Stable Custody Group II LLC (“Stable”). Stable and its affiliates are not depositories, banks, or credit unions, and the DDM program is NOT, itself, an FDIC-insured or NCUSIF-insured product. Rather, under the DDM program, your funds are swept or placed into deposit accounts at participating banks that are insured by the Federal Deposit Insurance Corporation (“FDIC”) for up to the current standard maximum deposit insurance amount (“SMDIA”) of $250,000 per eligible depositor, per insured participating institution, for each ownership capacity or category, including any other balances the depositor may hold at that institution directly or through other intermediaries, including broker-dealers. FDIC insurance coverage is only available to protect you against the failure of an FDIC insured institution, respectively, that holds your deposits under the DDM program (and not to protect against the failure of any other party, including Stable). The DDM program is primarily designed to provide administrative convenience for us to offer expanded FDIC insurance on your funds and is not designed to provide you with investment enhancements or higher rates of returns on your funds. Demand Deposit Marketplace®, DDM®, Reich & Tang® and R&T® are registered marks of Reich & Tang Deposit Networks, LLC (“R&T”). Stable is a subsidiary of R&T.